The car insurance landscape is rapidly changing in 2025. With emerging technologies shaping the industry, drivers need to understand this complexmarket with care. This in-depth review will contrast different insurance options, showcasing the essential considerations to provide you optimal coverage in the evolving world of car insurance.

- Begin by, it's important to assess your individual demands.

- Consider factors like your habits, the your car's worth, and your desired level of coverage.

- Research multiple options to evaluate their rates, benefits, and reviews.

Keep in mind that technology are transforming the way we obtain car insurance. Leverage these platforms to enhance your experience.

Top Car Insurance Deals of 2025: A Comprehensive Comparison

In the rapidly evolving world in automotive insurance, staying ahead on the curve is crucial. By 2025, consumers will be faced at an increasingly complex landscape to insurance options. To navigate this terrain effectively and secure the most favorable deals, a thorough evaluation of available policies is essential.

- Leveraging online comparison tools can streamline the process but, allowing you to quickly compare quotes from multiple insurers side-by-side.

- Think about your individual needs such as driving habits, vehicle type, and desired coverage levels in order to.

- Don't hesitate to research different options so negotiate toward insurers to obtain the most favorable rates.

By following these strategies, you can confidently find the car insurance policy best suited your needs and budget in 2025.

Leading Car Insurance Providers in 2025: A Comprehensive Comparison

Navigating the world of car insurance can be challenging, especially with the ever-changing landscape of providers and policies. By next year, the industry is poised for major shifts, with new players emerging and existing companies transforming to meet the demands of a dynamic market.

To help you find the right coverage, we've gathered a in-depth comparison of the top car insurance providers projected to lead in 2025. Our analysis considers factors such as cost stability, customer experience, and coverage choices.

This guide will provide valuable information to empower you to make an informed decision and obtain the best car insurance policy for your needs.

- Industry

The future of car insurance

By 2025 and beyond, the landscape of car insurance will be dramatically altered. Traditional models based on previous driving records may give way to advanced technologies that assess risk in real time. Companies will likely leverage data from connected cars and driver behavior to provide personalized rates. This shift could generate more reasonable coverage options for safe drivers, while those with a history of risky driving may face higher premiums.

Several creative insurance models are already being explored.

For example, consider this: pay-per-mile plans, which charges drivers based on their actual mileage. Another potential option is usage-based insurance, where devices monitor driving behavior and modify rates accordingly.

As|The increasing integration of driverless technology will significantly impact the future of car insurance.

Companies will need to evolve their risk assessment to factor in the unique concerns posed by autonomous vehicles.

The future of car insurance is ripe with opportunity.

By adopting new technologies and adjusting their approaches, insurers can design a more innovative system that benefits both drivers and the industry as a whole.

Cutting-Edge Comparisons for Car Insurance in 2025: Saving Money with Data-Driven Insights

In the rapidly evolving landscape of car insurance, data-driven insights are transforming the way consumers evaluate policies. By leveraging the power of big data and advanced algorithms, companies can now offer highly personalized quotes that account for individual commuting habits. This trend is expected to gain momentum in 2025, empowering consumers to secure the most affordable coverage options feasible.

Policyholders can anticipate a future where car insurance comparison is a streamlined experience. Intuitive platforms will aggregate data from multiple insurers, presenting concise comparisons that emphasize key elements. This Compare Car Insurance in 2025 accessibility will inherently reduce the time and effort required to locate the optimal car insurance policy, yielding consumers both money.

Car Insurance Trends 2025: A Guide to Smart Comparisons

By the year 2025, the car insurance landscape is undergoing with a emphasis on advanced solutions. Consumers must factor in these as they researching car insurance options.

One key trend is the growing demand for usage-based insurance plans uses tracking technology determine premiums..

Another significant trend is the AI-powered tools for assess risks and. This has the potential to more personalized insurance experiences.

To make informed comparisons in this evolving market, consumers should take the time to the following factors::

* Coverage options

*

* {Company reputation and customer service|Claims Handling)

* Technological features available to you

By doing so, you can secure the most suitable coverage.

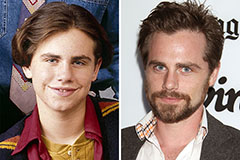

Rider Strong Then & Now!

Rider Strong Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!